In the dynamic landscape of finance, open banking systems are poised for significant growth, ushering in a new era of innovation across various financial sectors. From startups to established banks, open banking presents opportunities to expand service offerings, promote financial inclusion, and stimulate market expansion.

Exploring Open Banking

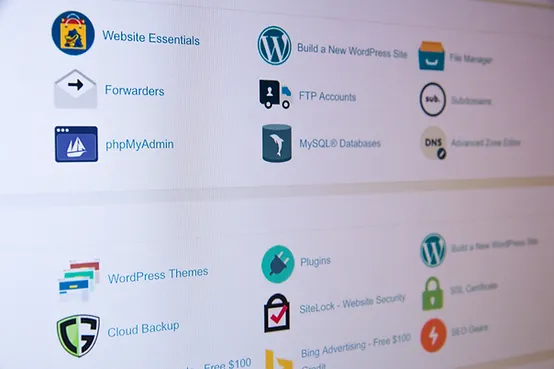

Open banking is a system where banks share customer data with third-party financial service providers through secure application programming interfaces (APIs). This sharing of data allows for the development of new financial products and services tailored to individual needs. By fostering collaboration and interoperability among different players in the financial ecosystem, open banking promotes competition, transparency, and efficiency.

Enhancing Customer Experience

One of the key benefits of open banking is the ability to deliver personalized and seamless customer experiences. With access to a wealth of financial data, banks and fintech startups can develop innovative solutions that address specific customer needs. Whether it’s optimizing currency exchange rates, facilitating cross-border transactions, or ensuring secure money transfers, open banking enables the creation of tailored services that enhance customer satisfaction and loyalty.

Driving Financial Inclusion

Open banking has the potential to bridge the gap between underserved populations and mainstream financial services. By leveraging open APIs, fintech companies can reach individuals who were previously excluded from traditional banking systems. This includes migrant workers seeking affordable cross-border payment solutions, small businesses in need of access to credit, and individuals in remote areas lacking physical bank branches. Through open banking, financial services become more accessible and inclusive, empowering individuals to participate in the formal economy.

Fueling Market Growth

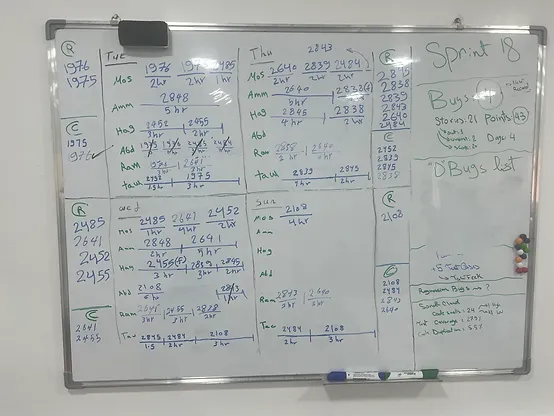

The adoption of open banking is expected to fuel market growth by stimulating innovation and competition. Startups, armed with open banking APIs, can enter the market with innovative solutions that challenge incumbent players and drive industry-wide innovation. This competition encourages incumbents to innovate and adapt, leading to the development of new products and services that benefit consumers. Additionally, open banking facilitates collaboration between banks and fintech startups, enabling the creation of integrated solutions that offer greater value to customers.

Future Outlook

As open banking continues to gain traction, its impact on the financial services industry will only grow stronger. With increased collaboration and data sharing, banks and fintech startups will unlock new opportunities for innovation and customer engagement. From streamlining currency exchange processes to facilitating secure cross-border payments, open banking will revolutionize how financial services are delivered and experienced.

open banking represents a paradigm shift in the financial services landscape, driving innovation, inclusivity, and market growth. By embracing open banking principles, banks and fintech startups can unlock new possibilities and create value for customers across diverse financial verticals.